September 2025 is flashing strong signals that an altcoin season may be underway. The Altcoin Season Index is climbing, BTC dominance is weakening, and capital is rotating into altcoins. Meanwhile, Digital Asset Treasuries (DATs) are accumulating billions in assets like ETH, SOL, and BNB, connecting institutional money with crypto and fueling momentum for a sustained altcoin boom.

1/ Market Signals

The Altcoin Season Index has steadily risen from 59 in early September to 69 at present, strengthening the case for an upcoming altcoin season.

What is the Altcoin Season Index? [link]

Notably, between September 18 and 20, the index climbed above 75 that signals altcoin season providing a strong bullish indicator. If the index continues to rise and holds above 75, we could see a clearer confirmation of an altcoin season.

In addition, the altcoin market cap (excluding BTC and ETH) has grown by around 8% since early September, suggesting that capital is increasingly flowing into altcoins.

Source: Coinmarketcap - https://coinmarketcap.com/charts/altcoin-season-index/

Furthermore, BTC dominance remains around 57%, while altcoin dominance stands at 29% and is showing signs of increasing. Historically, when BTC dominance falls below altcoin dominance, it has signaled the arrival of an altcoin season.

Source: Coinmarketcap - https://coinmarketcap.com/charts/bitcoin-dominance/

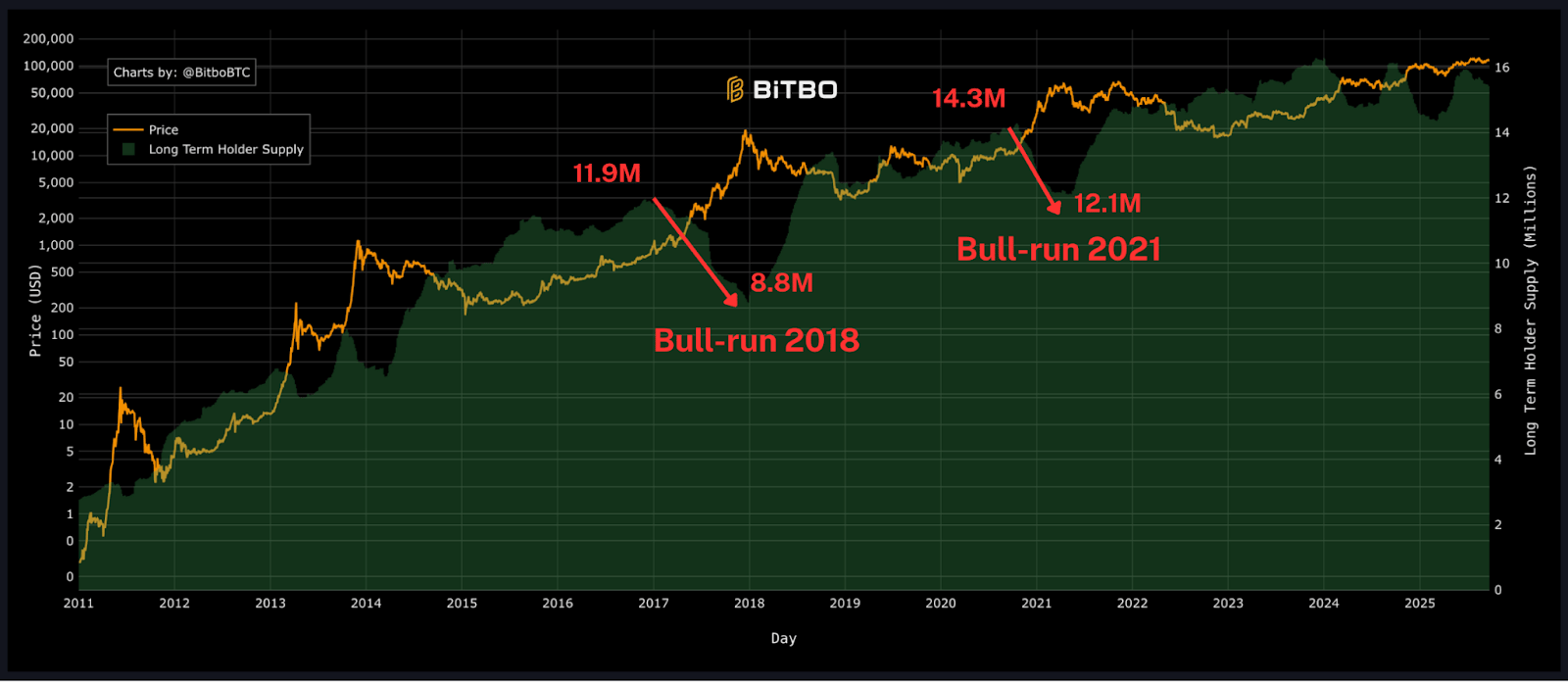

Notably, the Long-Term Holder (LTH) Supply has been showing a decline.

LTH Supply refers to the total amount of Bitcoin held by entities that have kept their coins for 155 days or more.

Historically, during the bull runs of 2018 and 2021, LTH Supply dropped significantly, reflecting profit-taking activity as capital rotated from BTC into other assets such as stablecoins and altcoins.

When combined with the rising altcoin market cap, this trend suggests that capital may once again be flowing out of BTC and into altcoins.

Among altcoin narratives, DeFi stands out, with its market cap recently reaching a new all-time high of over $4T. As the backbone of the crypto market, DeFi’s growth could serve as a strong signal for the arrival of an altcoin season.

Source: Coingecko - https://www.coingecko.com/en/charts?utm_source

2/ Digital Asset Treasury (DAT) Signals

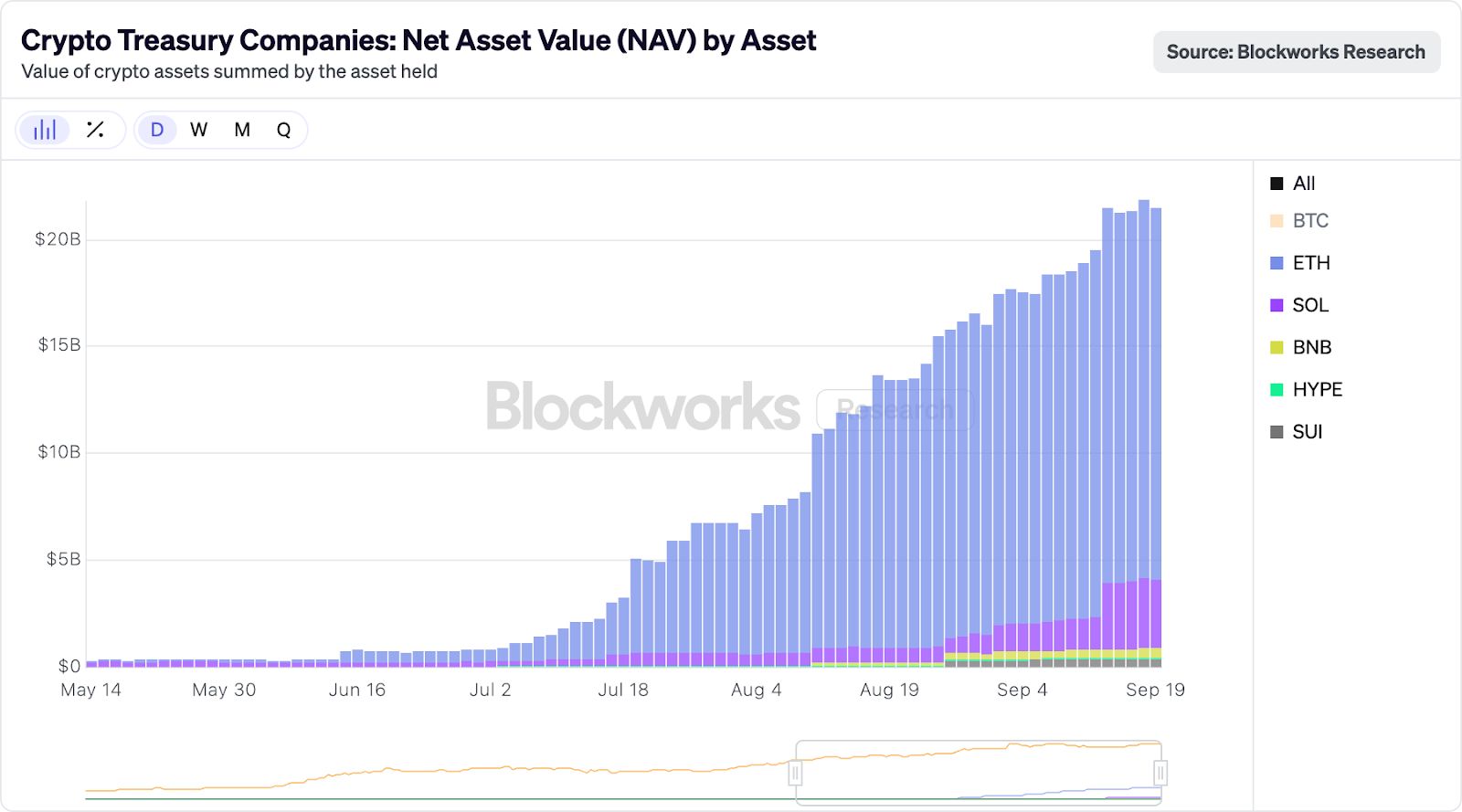

An increasing number of Digital Asset Treasuries (DATs) are being launched in the market. While BTC remains the most accumulated asset, more treasuries are also starting to include altcoins in their reserves.

Currently, ETH, SUI, SOL, BNB, and HYPE are gaining notable attention, with DATs collectively holding over $20B worth of these altcoins.

Beyond these altcoins, many other assets are also supported by DATs, and their adoption is expected to keep rising in the future.

These are positive signs for altcoins for several reasons:

1. Brings in Big Money

Digital Asset Treasuries (DATs) allow institutions to allocate billions into altcoins, improving liquidity and driving prices higher. This increases altcoin market share (with dominance above 75%) and signals growing adoption.

2. Expands Assets Over Time

By staking or lending their holdings for yield, DATs compound value and attract more investors. This not only supports rising altcoin prices but also inspires similar treasury structures across other chains.

3. Builds Hype and Momentum

DATs shift attention away from Bitcoin and toward altcoin ecosystems (such as Solana), fueling cycles of price growth, investor interest, and extended altseasons.

In summary, DATs bridge traditional finance and crypto, creating consistent buying forces that help ignite and sustain altcoin booms.