As CZ mentioned in his speech, DeSci, AI, and Education are worth monitoring, especially on the BNB Chain. Given his reputation as one of the most influential KOLs with strong impact on market movements, this could develop into a powerful narrative with strong potential for future outperformance.

1/ DeSci - BIO Launchpad and Its Ecosystem

Why Does It Matters?

DeSci is one of the emerging narratives this season, offering strong practical utility. It bridges the scientific community with the Web3 ecosystem to facilitate funding. With its noble mission, DeSci has the potential to build strong conviction among investors and support projects developing solutions to improve healthcare and create treatments for diseases that affect billions of people worldwide.

Key Projects

Some of the main DeSci projects I’m watching include:

BIO Protocol: The leading project in this narrative, with strong backing from Binance and CZ.

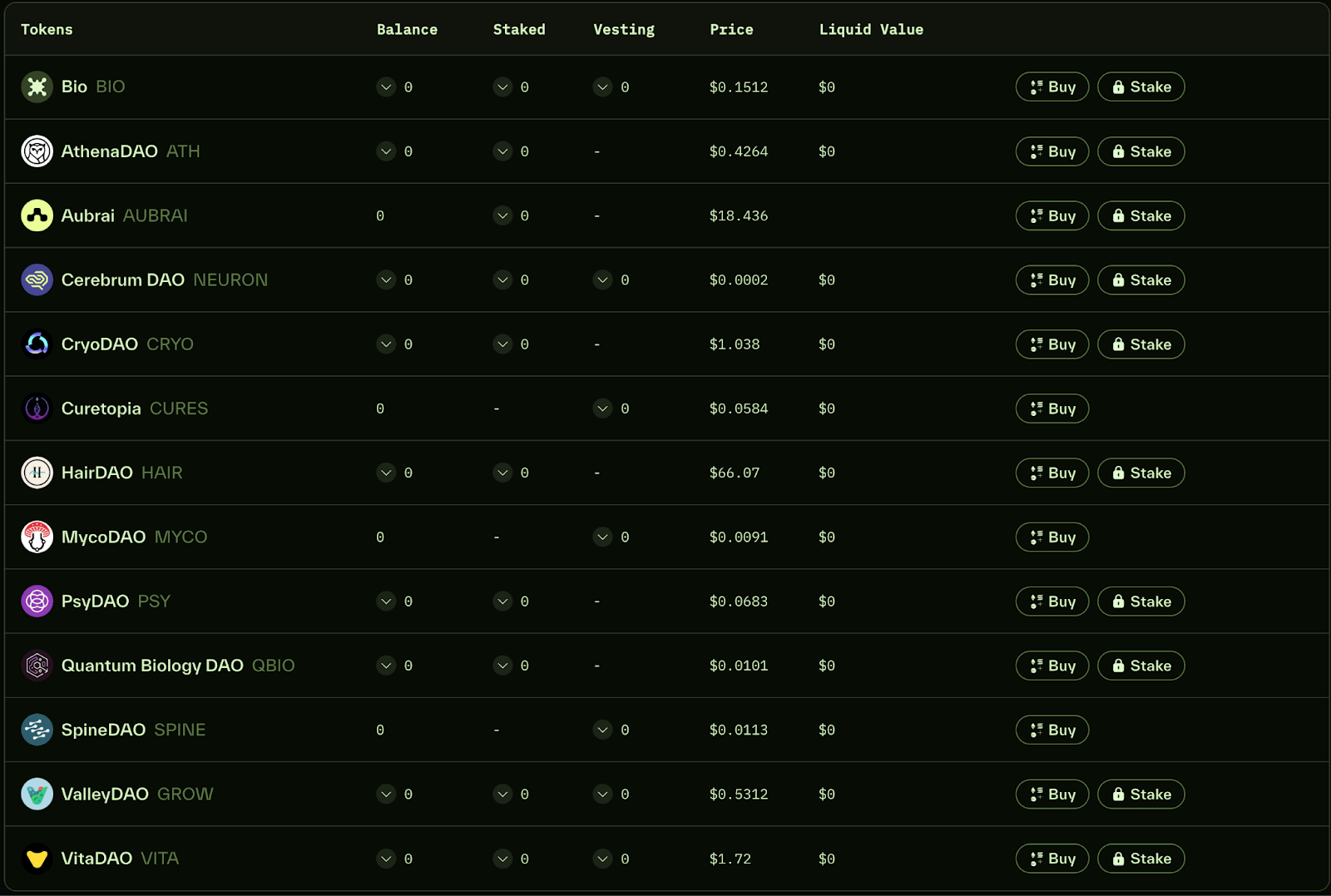

BIO Ecosystem:

VITA: Backed by the BIO team with strong support.

RSC: Supported through BIO’s partnerships.

AUBRAI: Strongly supported by BIO and positioned as the first launchpad on the BIO ecosystem.

How to Get Skin in the Game?

Currently, participation in the BIO Launchpad requires pledging points through a virtual gameplay system.

How to Collect Points:

Yap: Create content on X (Twitter) about BIO.

Staking Assets: Most participants are staking $BIO, but you can also stake other tokens in the BIO ecosystem.

Your allocation to buy will depend on the dominance of your pledged points. The more points you pledge, the higher your allocation will be.

At present, Yapping is the more efficient strategy for retail users, since it allows them to earn points by creating content without upfront costs. However, based on the latest plan, BIO will increase the weight of staking assets in point calculation. → Change the strategy to stake + yap

If you participate in the launchpad, sell 50% of the tokens you receive and stake the remaining 50% back into the platform. Selling everything may flag you as a bad-behavior user, which would prevent you from earning points for the next launchpad.

Source: https://app.bio.xyz/portfolio

Risks & Considerations:

If you are only a BIO investor:

Expect sell pressure from short-term players, especially whales

Be prepared for a volatile market

Consider the vesting schedule of early investors

If you are both a BIO investor and a launchpad participant:

Be aware of all the risks mentioned above

Choose efficient strategies for farming points instead of going all-in on staking

Monitor whale movements closely

Research carefully before pledging points (since points can be burned or expire, make well-informed decisions)

2/ AI

Why Does It Matter?

AI adoption has been accelerating rapidly in recent years, with more companies integrating AI into their products and services. Web3 is no exception. The wide utility of AI and its alignment with global technology trends make it a powerful force shaping the crypto space.

Key Projects Backed by Binance

Arkham: A leading analytics tool in the market.

Sahara: A top infrastructure provider for AI applications.

Vana: Backed by Binance, with CZ serving as an advisor.

AI is expected to play a key role not only in the future of Web3 but also in broader technological and societal development.

Risks & Considerations

While the AI narrative is strong, investors should remain cautious about potential risks:

Tech Hurdles: Issues such as poor data quality, model failures, and execution challenges can undermine value.

Bubble Risk: Overhyped valuations echo the dot-com era, with sharp corrections likely if growth slows.

High Volatility: AI-related crypto tokens are highly sensitive to hype cycles, market sentiment, and broader crypto downturns.

Adoption & Maturity Gaps: Limited real-world use cases, technological immaturity, and strong competition may quickly erode value.

3/ Education

Giggle Academy, launched by CZ, has sparked intense FOMO on X due to its rapid fundraising success raising over $1M - $3M in hours via crypto donations, primarily through the $GIGGLE memecoin on BSC.

This aligns with 2025 trends of blockchain-based EdTech, leveraging BSC’s low fees and scalability to deliver tokenized learning, credentials, and community-driven education.

Why does it matter?

Giggle Academy exemplifies how BSC can power decentralized EdTech by using crypto donations and memecoins to fund free, global education, targeting underserved communities with gamified, blockchain-verified learning.

Its success $3M in donations within 36 hours, shows strong community support and validates blockchain’s potential for social impact beyond speculation.

In Q4, as BSC’s TVL grows with DeFi and memecoin surges, Giggle Academy could drive mainstream adoption of EdTech dApps, leveraging BSC’s low-cost transactions for microlearning payments and NFT credentials.

Key Projects

Giggle Academy: CZ’s platform for free K-12 education, with 67+ gamified courses and 31K+ users. Funded by $GIGGLE’s 5/5 taxes and donations, SBTs proposed for credentials.

Open Campus / EDU Chain: Layer 3 on Arbitrum Orbit, with $EDU for content/governance and Publisher/Genesis NFTs. Serves 20M+ learners, backed by Binance.

BitDegree: Tokenized courses with Learn2Earn rewards, EVM-compatible for BSC.

ODEM Network: Decentralized education marketplace with $ODE for payments and on-chain certifications, partnered with European universities.

Tutellus: Learn2Earn platform with $TUT staking for courses, NFT certificates, and DeFi rewards, on Polygon but BSC-compatible.

How to Skin In the Game

Trade Tokens: Buy $GIGGLE, $EDU, $BDG, $ODE, or $TUT to capitalize on Q4 altcoin surges, driven by Open Campus hackathons or Giggle’s expansions.

Provide Liquidity: Stake $EDU or $GIGGLE in BSC DeFi pools for yields during Q4 TVL growth.

Learn2Earn: Complete courses on BitDegree, ODEM, Tutellus, or Giggle Academy for token rewards or NFT credentials.

Join TGEs: Monitor @OpenCampus_xyz or @GiggleAcademy for Q4 TGEs participate in presales/airdrops.

Risks

Volatility: $GIGGLE, $EDU, $BDG, $ODE, $TUT may face Q4 price swings, especially if donations convert to stables.

Regulatory Hurdles: Tokenized credentials and rewards risk privacy or securities scrutiny.

Adoption Barriers: Resistance from traditional education systems may limit growth.

Smart Contract Risks: Exploits in wallets or dApps could lead to losses.

Unconfirmed TGEs: Speculative Giggle token launches may not occur.

Market Downturns: Q4 crypto crashes could reduce TVL and funding.